Highland Copper announces positive PEA results and mineral resource estimate

for the White Pine North Copper Project in Michigan

September 23, 2019 – Longueuil, Québec. Highland Copper Company Inc. (TSXV: HI, OTCQB: HDRSF) (“Highland” or the “Company”) announces results of a preliminary economic assessment (“PEA“) and a mineral resource estimate for the White Pine North Copper Project (the “Project”) located in the historical copper range district of the Upper Peninsula of Michigan, U.S.A.

The PEA provides a base case assessment of mining the mineral resources of the White Pine Project. The PEA considers White Pine North as a stand-alone project and utilizes existing infrastructure to minimize initial capital expenditures. The Project is the extension of the historical White Pine mine which operated from 1953 to 1995. The PEA was prepared in connection with the Company’s ongoing strategic review process. The PEA and mineral resource estimate have been prepared by G Mining Services Inc. (“GMSI”).

All amounts in this news release are in US dollars, unless otherwise indicated. Due to rounding, numbers presented throughout this release may not add up precisely to the totals provided.

PEA Highlights

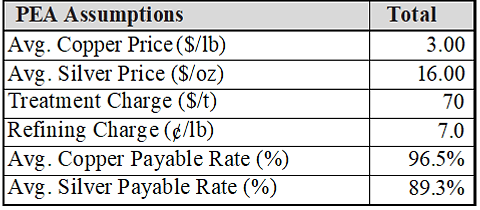

• Base case using a copper price of $3.00/lb and a silver price of $16.00/oz

• After-tax internal rate of return (“IRR”) of 16.8%

• After-tax net present value (“NPV”) at 8% of $416 million

• Initial capital expenditures of $457 million, net of pre-production revenue of $56 million

• Life-of-mine (“LOM”) cash costs of $1.40/pound, including royalties

• Indicated mineral resource of 133.4 M tonnes at 1.07% Cu and 14.9 g/t Ag, containing 3.2 billion pounds of copper and 63.8 million ounces of silver.

• Inferred mineral resources of 97.2 M tonnes at 1.03% Cu and 8.7 g/t Ag, containing 2.2 billion pounds of copper and 27.2 million ounces of silver

• Mineral resources included in the mine plan of 121.4 M tonnes @ 0.98% Cu and 11.80 g/t Ag, containing 2.6 billion pounds of copper and 46.1 million ounces of silver

• Mine life of 25 years, including one year of ramp-up, with average annual LOM payable copper production of 89 million pounds and 1.3 million ounces of silver

The reader is advised that a PEA is preliminary in nature and is intended to provide only an initial, high-level review of the Project potential and design options. The PEA mine plan and economic model include numerous assumptions and the use of Inferred resources. Inferred resources are too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and to be used in an economic analysis except as allowed for in PEA studies. There is no guarantee that Inferred resources can be converted to Indicated or Measured resources, and as such, there is no guarantee the Project economics described herein will be achieved.

In May 2014 Highland completed the interim closing of the acquisition of the White Pine North Project from Copper Range Company (“CRC“), a subsidiary of First Quantum Minerals Ltd. The final closing of the acquisition is subject to several conditions including releasing CRC from certain environmental obligations associated with the remediation and closure plan of the historical White Pine mine site and replacing the related environmental bond for an amount expected to be approximately US$1.7 million. The deadline to complete the acquisition of the White Pine North Project from CRC has been extended to January 31, 2020. A large portion of the Mineral resources are located on the CRC property. There can be no assurance that the Company will be able to complete the acquisition of the White Pine North Project.

White Pine North Project Geology

The White Pine deposit is in the Ontonagon County, Michigan State. The base of the Nonesuch Formation hosts the bulk of the copper mineralization at White Pine, which consists of cupriferous siltstone, black shale and fine-grained sandstone beds, and low-grade siltstone, sandstone and red shale beds.

The copper mineralization in the area of the former White Pine mine occurs in the bottom 6 m (20 ft) of the Nonesuch Formation at the contact with the Copper Harbor conglomerate. Beds within the lower 21 m (70 ft) of the Nonesuch Formation are laterally persistent and can be correlated across the mine. The shale and siltstone in the lower part of the Nonesuch Formation are divided into two sedimentary sequences, the lower “Parting Shale” and the upper “Upper Shale”, separated by the Upper Sandstone.

Copper mineralization at the White Pine deposit occurs as two distinct styles — very fine-grained sulfide (chalcocite) and as native copper. Sulfide mineralization is estimated to account for 85-90% of the copper in the deposit, but both modes of copper are intimately associated throughout the deposit.

Mineral Resources

GMSI prepared a Mineral Resource estimate for the White Pine North Project based on data provided up to and including March 2015. No new scientific or technical data has been acquired since March 2015, therefore this mineral resource can be considered as current and effective as of August 30, 2019. Database used by GMSI which had been validated by an independent arm’s-length consultant includes 526 drill holes from available historical drilling by CRC and an additional 42 diamond drill holes in HQ and NQ diameter core completed by the Company in 2014 and 2015, totaling 274,914 meters and 15,743 assays.

The resource estimate was prepared in accordance with CIM Standards on Mineral Resources and Reserves (adopted May 10, 2014) and is reported in accordance with Canadian National Instrument 43 101 – Standards of Disclosure for Mineral Projects (“NI 43 101”). Classification, or assigning a level of confidence to Mineral Resources, has been undertaken with strict adherence to CIM Standards on Mineral Resources and Reserves. In the opinion of GMSI, the resource evaluation reported herein is a reasonable representation of the global Mineral Resources found at the White Pine North Project at the current level and spacing of sampling.

The Mineral Resource estimate was prepared under the supervision of Réjean Sirois, P. Eng. of GMSI, an independent “qualified person” as defined in NI 43 101. Geovia GEMS™ and Leapfrog Geo™ software were used to facilitate the resource estimation process.

The modelling of the copper mineralization horizons was based on the footwall and hanging wall of the three selected “columns” (sedimentary sequences), namely the Parting Shale, the Full Column and the Upper Shale. These columns were modelled with a minimum true thickness of 2 m. In instances where the columns were less than 2 m, dilution was applied in the footwall to ensure that the 2 m thickness was honored. Only the Parting Shale column was reported as a Mineral Resource.

Copper and silver assays were composited to the full thickness of the column. Grade distributions were reviewed, and assay capping was not deemed necessary.

Grade estimation was undertaken using Ordinary Kriging (OK) and Inverse Distance Squared (ID2) into a percentage block model based on the wireframes of the three columns. A three-pass estimation strategy was adopted, with increasingly large search ellipses and relaxed estimation parameters.

The block model was validated visually and statistically and was found to be a good representation of the composites. Mineral Resource classification was based primarily on estimation pass, and other considerations such as drill spacing, quality of historical data and confidence in grade continuity.

A 300 m buffer zone around existing workings was excised from the Mineral Resource.

Total Indicated Mineral Resources of the White Pine North deposit are reported at 133.4 M tonnes grading an average of 1.07% Cu and 14.9 g/t Ag, containing 3.2 billion pounds of copper and 63.8 million ounces of silver using a cut-off grade of 0.9% Cu for the Parting Shale column only. Inferred Mineral Resources are reported at 97.2 M tonnes grading an average of 1.03% Cu and 8.7 g/t Ag, containing 2.2 billion pounds of copper and 27.2 million ounces of silver using a cut-off grade of 0.9% Cu.

Notes on Mineral Resources:

-

Mineral Resources are reported using a copper price of US$ 3.00/lb and a silver price of US$ 16/oz

-

A payable rate of 96.5% for copper and 89.3% for silver was assumed.

-

Metallurgical recoveries of 88% for copper and 76% of silver were assumed.

-

A cut-off grade of 0.9% Cu was used based on an underground “room and pillar” mining scenario

-

Operating costs are based on a processing plant located at the White Pine site.

-

A flat NSR royalty rate of $0.05/lb Cu payable was applied, which incorporates two royalties on the project (Osisko Gold Royalty and Great Lakes Royalty)

-

The Parting Shale Column was modelled using a minimum true thickness of 2 m

-

No mining dilution or mining loss was considered for the Mineral Resources

-

Mineralized rock bulk density is assumed at 2.7 g/cc

-

Classification of Mineral Resources conforms to CIM definitions

-

The qualified person for the estimate is Mr. Réjean Sirois, P.Eng., Vice President – Geology and Resource for GMSI. The estimate has an effective date of August 30, 2019

-

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

-

Parting Shale: Interval defined from the base of the Lower Transition to the top of the Tiger units

-

The quantity and grade of reported Inferred Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured Mineral Resources.

Mining Plan

The PEA envisions that the deposit will be mined with a conventional highly mechanized, drill and blast room-and-pillar mining method. The method consists of the extraction of a series of entries and cross-cuts in the mineralization, leaving pillars in place to support the back. The entries, cross cuts and pillars have been sized using geotechnical analysis and experience from historical mining at White Pine.

The mine will comprise three sectors; the Eastern, Center and Western parts. The mine will be accessed via a new covered box-cut to establish a portal at the mine entrance from the surface, located at the western side of the deposit. The pre-production period requires 41,512 m of development to establish the main entry panel requiring four to six drifts according to the ventilation requirements. Ground conditions are expected to be good to excellent, similar to the historical White Pine mine. The ground support consists a 1.8 m rebar bolts on a 1.2 m by 1.2 m pattern.

The production schedule is based on mining a fixed target of 5.4 M tonnes/year. To achieve this annual production, seven to fourteen production panels must be in production simultaneously. The number of required panels depends on the tonnage from the development as well as the height of the rooms of each panel. The mining of the room will be done using a two-pass approach. In the first pass, larger pillars are left in place. The mining recovery of the first pass is estimated at 40%. Once the first pass is completed, the size of the pillars is reduced via a second pass to increase the average mining recovery to approximately 57%.

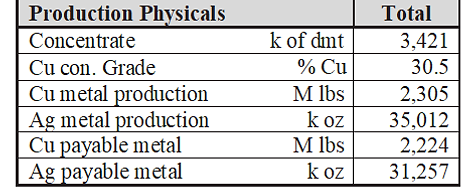

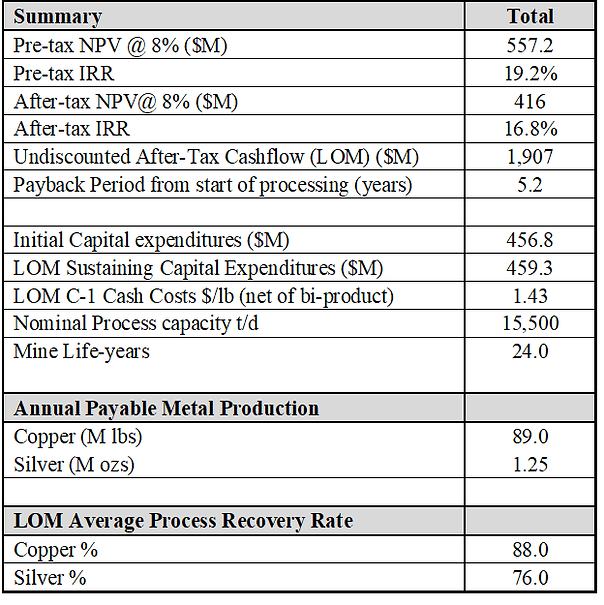

Life-of-Mine (LOM) Metal Production

The PEA LOM production estimate for the White Pine North Project is shown below. Payable copper production is estimated at 1 Mt (2.2 billion pounds) with an annual average of 40,000 tonnes (89 million pounds) over the 25-year mine life which includes a 1-year commissioning and ramp-up period. The average payable rate is 96.5% which includes a 0.2% concentrate loss. Payable silver production over the LOM is 31.3 million ounces with an annual average of 1.3 million ounces of silver.

Processing and Metallurgy

The PEA envisions a process plant design for the Project that is based on the historical metallurgical flowsheet to produce copper concentrate with a nominal throughput of 15,000 tpd and a planned availability of 91.3%. The flowsheet consists of crushing, grinding in closed circuit with a ball mill targeting a primary grind of 100 microns, rougher flotation with concentrate regrind, cleaner flotation using three stages of cleaning, concentrate thickening, filtration and tailings disposal.

The copper recovery is estimated at 88% with a concentrate grade of 30.5% Cu. Silver recovery is estimated at 76%. Studies show that copper recovery might be further increased by concentrate grade and reagents optimization.

Power and Surface Infrastructure

The Company envisions building a new natural gas fired power generation plant. The site is currently serviced with natural gas. The power plant capacity is estimated at 30 MW. The existing tailings disposal facility will be utilized to deposit tailings from the White Pine North project, which will require dam raises over the life-of-mine. Water supply is available from an existing Lake Superior pump station. A new 2 km access road to the project processing and administrative complex is planned from the Michigan M-64 highway.

Capital and Operating Costs

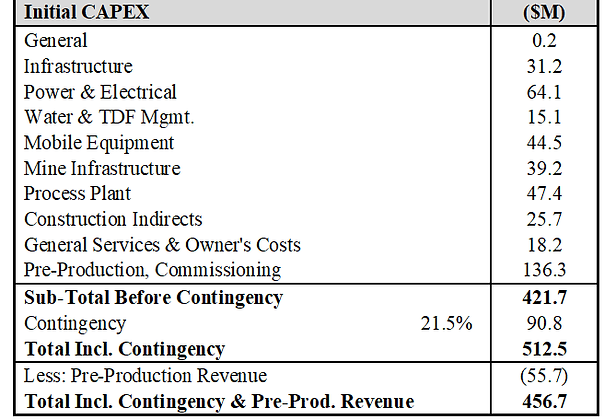

The initial capital costs, including all direct and indirect costs, are estimated at $512.5 million, including a contingency of $90.8 million. It is anticipated that pre-production revenue of $55.7 million will reduce the capital expenditures to $456.7 million.

Initial Capital Expenditure Summary

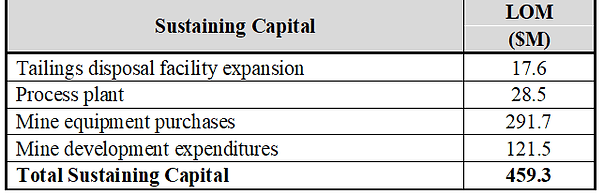

Sustaining Capital Expenditure Summary

The total LOM sustaining capital is estimated at $459.3 million. The sustaining capital includes the extension of the conveyor system for extracting ore to surface and replacement of equipment which typically has a useful life of 50,000 hours.

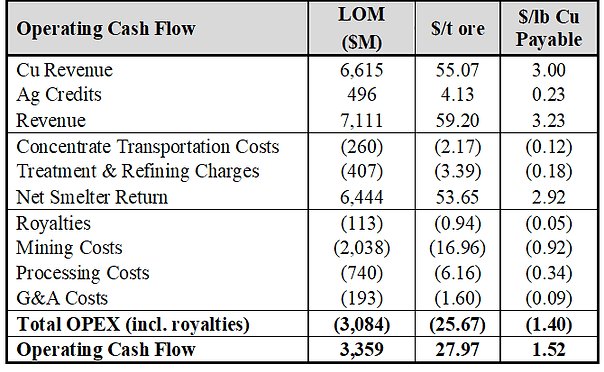

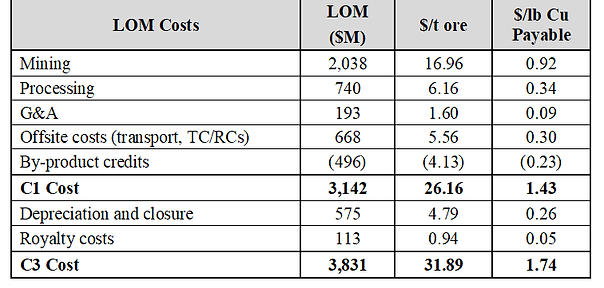

Operating Costs Summary

Operating costs include mining, processing, G&A services, concentrate transportation and concentrate treatment and refining charges. The concentrate transportation, treatment charges and refining are deducted from gross revenues to calculate the net smelter return (“NSR”). The NSR for the Project during operations is estimated at $6.4 billion, excluding $55.7 million of NSR generated during pre-production and presented as a reduction of initial capital expenditures. The average NSR over the LOM is $2.92 per pound of payable copper. The average operating cost over the LOM is $25.67 per tonne of ore or $1.40 per pound of payable copper with mining representing 66% of the total operating costs, or $16.96 per tonne of ore.

Note: Ore tonnage and payable copper unit costs excluding commissioning period.

Sensitivity Analysis

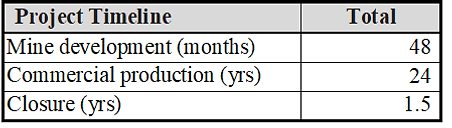

Estimated Timeline

The estimated timeline for the White Pine North Project is shown below. Upon receipt of required permits and necessary approvals a 48-month mine development, construction and commissioning period is foreseen followed by 24 years of commercial production.

PEA Assumptions

Preliminary Economic Assessment

All-in Cash Cost

Environment and Permitting

The former White Pine mine ceased operation in 1995 and has been the subject of an extensive remediation program outlined in judicial Consent Decree and Remedial Action Plan agreements between CRC, Michigan’s Attorney General and the Michigan Department of Environment, Great Lakes, and Energy. The entire surface area overlying the underground mine along with the associated surface component area and tailings impoundments are listed as a “facility” under Part 201, Environmental Remediation, of Michigan’s Public Act 451 of 1994 as Amended, the Natural Resource and Environmental Protection Act.

Pending final closing of the acquisition of the Project, the Company began mineral exploration and baseline environmental surveys under an access agreement with CRC. Historical environmental data for the former White Pine mine site operated by CRC was reviewed and compared with the Company’s initial project plans and Michigan’s Part 632 regulatory requirements. CRC had compiled extensive information on surface water, ground water and near-surface soils at the project site. Biological monitoring data in the Project area was mostly limited to very brief descriptions, e.g. the Remedial Investigation Report of 1999, or the more thorough description of the 1978 Baker report that is now over 40 years old. Data from limited nearby stream monitoring completed by the State of Michigan in 1999 and earlier is also available.

Upon completion of the final closing of the acquisition of the mineral and surface rights from CRC, the Company will assume all environmental liabilities related to the Consent Decree and on-going environmental obligations.

Qualified Persons

Louis-Pierre Gignac, P. Eng., of GMSI, an independent qualified person, as defined under NI 43-101, has read and approved the technical portions of this news release. The following qualified persons are responsible for the preparation of their relevant portions of the technical report to be prepared in accordance with NI 43-101.

Technical Report

The Company is planning to file a technical report in accordance with NI 43-101 on SEDAR, within 45 days from the date of this news release. Readers are cautioned that the conclusions, projections and estimates set out in this news release are subject to important qualifications, assumptions and exclusions, all of which are detailed in the technical report. To fully understand the summary information set out in this news release, the technical report that will be filed on SEDAR should be read in its entirety.

About the White Pine North Project

The White Pine North Copper Project is located in the historical copper range district of the Upper Peninsula of Michigan, approximately 7.5 km south of Lake Superior in Ontonagon County. The Project covers approximately 4,500 hectares (11,000 acres) of surface rights and approximately 11,990 hectares (29,615 acres) of mineral rights. The former White Pine mine was in production from 1953 through 1995. By the time it closed, over 4.5 billion pounds of copper had been produced from the mine. A large portion of the Project is subject to final closing of the acquisition from CRC as described above. Approximately 1,816 acres of mineral rights are being leased by the Company under a lease agreement with a Michigan corporation.

About Highland

Highland Copper Company Inc. is a Canadian-based company focused on exploring and developing copper projects in the Upper Peninsula of Michigan, U.S.A. The Company’s principal assets are the Copperwood Project, a development stage copper project fully permitted to move into the construction stage and the White Pine North Project (subject to final closing). More information about the Company is available on the Company’s website at www.highlandcopper.com and on SEDAR at www.sedar.com.

Cautionary Note Regarding Forward-Looking Statements

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the final closing of the acquisition of the White Pine Project and timing, results of the preliminary economic assessment, the mineral resource estimate; conceptual mine plan and operations; mining methods; design parameters; infrastructure requirements and timing; operating costs; capital costs; life of mine; royalties; strip ratio; reclamation costs; exchange rate; potential recoveries; the timing and cost for production decisions; production data, taxes; net present value; internal rate of return; sensitivities; and economic potential; permitting timelines and requirements; additional opportunities to enhance the overall project economics through additional exploration and efficiencies; the potential for discovery of additional mineral resources; increase in the copper and silver recoveries; production timing; and the Company’s objectives and strategies. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”, “target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which Highland operates, are inherently subject to significant operational, economic, and competitive uncertainties, risks and contingencies. There can be no assurance that such statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include interpretation of drilling results and other geological and geotechnical data, actual exploration results, interpretation of metallurgical characteristics of the mineralization, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required approvals, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators, including those described under the heading “Risks and Uncertainties” in the Company’s annual and most recently filed MD&A. These forward-looking statements involve certain risks and uncertainties, including, without limitation, being unable to meet the final closing conditions of the acquisition of the White Pine Project on terms acceptable to the Company, CRC and the Michigan Department of Environment, Great Lakes, and Energy for the transfer of environmental obligations. The Company does not undertake to update or revise any forward-looking statements, except in accordance with applicable law. Readers are cautioned not to put undue reliance on these forward-looking statements.

Cautionary Note to United States Investors

Highland advises U.S. investors that this press release refers to the terms “inferred”, “indicated” and “measured” “resources”, which are recognized and required by NI 43-101 but not recognized by the U.S. Securities and Exchange Commission (“SEC“). The SEC requires mining companies in their filings with the SEC to disclose only those mineral deposits that a company can economically and legally extract or produce. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred resource” will ever be upgraded to a higher category. U.S. investors are cautioned not to assume that all or part of an inferred resource exists, or is economically or legally mineable. U.S. Investors are also cautioned not to assume that all or any part of mineral deposits in the “measured” or “indicated” resource categories will ever be converted into reserves.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information, please contact:

Denis Miville-Deschênes, President & CEO

Tel: +1.450.677.2455

Email: info@highlandcopper.com